Structural Steel Detailing Service Should Charge State Taxes In Texas?

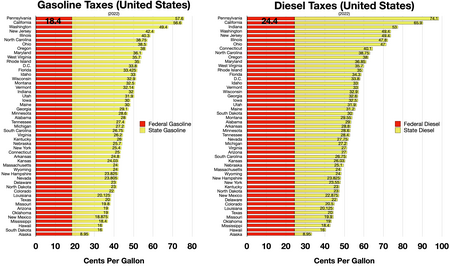

The United States federal excise tax on gasoline is 18.4 cents per gallon and 24.4 cents per gallon for diesel fuel.[ane] [2] The federal tax was concluding raised October 1, 1993 and is not indexed to inflation, which increased 77% from 1993 until 2020. On average, as of April 2019[update], state and local taxes and fees add 34.24 cents to gasoline and 35.89 cents to diesel, for a total The states volume-weighted boilerplate fuel taxation of 52.64 cents per gallon for gas and lx.29 cents per gallon for diesel.[three]

Land taxes [edit]

The first Us state to taxation fuel was Oregon and was introduced on February 25, 1919.[four] Information technology was a 1¢/gal tax.[5] In the following decade, all of the US states (48 at the fourth dimension), along with the Commune of Columbia, introduced a gasoline tax. Past 1939, the many states levied an average fuel revenue enhancement of 3.8¢/gal (ane¢/L).

In the years since being created, land fuel taxes have undergone many revisions.[half-dozen] While near fuel taxes were initially levied every bit a fixed number of cents per gallon, as of 2016[update], nineteen states and District of Columbia have fuel taxes with rates that vary aslope changes in the price of fuel, the inflation rate, vehicle fuel-economic system, or other factors.[seven]

The tabular array below includes state and local taxes and fees. The American Petroleum Institute uses a weighted average of local taxes by population of each municipality to come up up with an average tax for the entire state. Similarly, the national average is weighted past volume of fuel sold in each state. Because many of united states of america with the highest taxes also have higher populations, more states (i.due east., the less populated ones) accept below average taxes than above average taxes.

Most states exempt gasoline from full general sales taxes. Notwithstanding, several states do collect total or partial sales tax in addition to the excise tax. Sales tax is non reflected in the rates below.

| State | Gasoline tax (¢/gal) (excludes federal tax of 18.4¢/gal) | Diesel tax (¢/gal) (excludes federal tax of 24.4¢/gal) | Notes |

|---|---|---|---|

| Alabama | 29.21 | 30.15 | |

| Alaska | fourteen.66 | fourteen.40 | |

| Arizona | 19.00 | 27.00 | |

| Arkansas | 24.fourscore | 28.eighty | |

| California | 66.98 | 93.08 | Gasoline field of study to 2.25% sales tax. Diesel discipline to ix.25% sales tax. |

| Colorado | 22.00 | 20.fifty | In the urban center of Colorado Springs, Off-road Dyed Diesel and Gasoline are discipline to a local city sales taxation. |

| Connecticut | 35.75 | 44.x | Subject to boosted 8.1% sales tax |

| Delaware | 23.00 | 22.00 | |

| Commune of Columbia | 28.lxxx | 28.lxxx | |

| Florida | 42.26 | 35.57 | may also be subject to local option taxes of upward to an additional 12 cents |

| Georgia | 36.09 | 39.17 | subject to local sales taxation |

| Hawaii | 50.17 | 50.81 | too field of study to county tax of eight.8-18.0 cents and additional sales tax |

| Idaho | 33.00 | 33.00 | |

| Illinois | 59.56 | 65.22 | |

| Indiana | 49.79 | 54.00 | Gasoline subject to additional 7% use tax. No additional taxation on Diesel |

| Iowa | thirty.00 | 32.l | |

| Kansas | 24.03 | 26.03 | |

| Kentucky | 26.00 | 23.00 | |

| Louisiana | 20.01 | 20.01 | |

| Maine | 30.01 | 31.21 | |

| Maryland | 36.10 | 36.85 | |

| Massachusetts | 26.54 | 26.54 | |

| Michigan | 45.12 | 44.46 | subject to additional vi% sales tax |

| Minnesota | xxx.60 | 30.60 | |

| Mississippi | 18.79 | 18.40 | |

| Missouri | 17.42 | 17.42 | |

| Montana | 32.75 | xxx.20 | |

| Nebraska | 28.sixty | 28.00 | |

| Nevada | fifty.48 | 28.56 | also subject area to boosted local taxes |

| New Hampshire | 23.83 | 23.83 | |

| New Jersey | 42.4 | 49.4 | |

| New Mexico | 18.88 | 22.88 | |

| New York | 46.nineteen | 44.64 | discipline to additional state sales taxation of 4% (capped at $ii.00/gal) and local sales revenue enhancement (non capped), boilerplate combined sales taxes add roughly 20 cents |

| North Carolina | 36.35 | 36.35 | |

| North Dakota | 23.00 | 23.00 | |

| Ohio | 38.51 | 47.01 | |

| Oklahoma | 20.00 | xx.00 | |

| Oregon | 38.83 | 38.06 | additional local option of 1 to 5 cents |

| Pennsylvania | 58.70 | 75.20 | |

| Rhode Island | 35.00 | 35.00 | |

| South Carolina | 26.75 | 26.75 | |

| S Dakota | xxx.00 | 30.00 | |

| Tennessee | 27.forty | 28.40 | |

| Texas | xx.00 | 20.00 | |

| Utah | 31.41 | 31.41 | |

| Vermont | 31.28 | 32.00 | |

| Virginia | 34.40 | 35.30 | |

| Washington | 49.xl | 49.twoscore | |

| West Virginia | 35.70 | 35.lxx | |

| Wisconsin | 32.90 | 32.xc | |

| Wyoming | 24.00 | 24.00 |

Federal taxes [edit]

| Federal gasoline tax | |

| Source[nine] | |

The first federal gasoline taxation in the United States was created on June half-dozen, 1932, with the enactment of the Revenue Deed of 1932, which taxed 1¢/gal (0.3¢/Fifty). Since 1993, the United states federal gasoline revenue enhancement has been unchanged (and not adjusted for inflation of about 68-77% through 2016, depending on source) at eighteen.4¢/gal (4.86¢/50). Dissimilar most other appurtenances in the U.s.a., the price advertised (e.k., on pumps and on stations' signs) includes all taxes, every bit opposed to inclusion at the point of buy (i.e., equally opposed to prices of goods in, east.g., many stores advertised on shelves without tax which is instead calculated at checkout past many vendors).

Then-Secretary of Transportation Mary Peters stated on August 15, 2007, that near 60% of federal gas taxes are used for highway and bridge construction. The remaining twoscore% goes to earmarked programs, including a minority for mass transit projects.[10] Nonetheless, revenues from other taxes are besides used in federal transportation programs.

Federal tax revenues [edit]

Federal tax revenue on gasoline and diesel

Federal fuel taxes raised $36.iv billion in Fiscal Year 2016, with $26.i billion raised from gasoline taxes and $10.3 billion raised from taxes on diesel and special motor fuels.[11] The revenue enhancement was last raised in 1993 and is not indexed to inflation. Total inflation from 1993 until 2017 was 68 percent or up to 77 percentage, depending on source.[12] [13]

Public policy [edit]

Some policy advisors believe that an increased tax is needed to fund and sustain the country's transportation infrastructure, including for mass transit. As infrastructure structure costs take grown and vehicles have become more fuel efficient, the purchasing power of fixed-rate gas taxes has declined (i.due east., the unchanged tax rate from 1993 provides less existent coin than it originally did, when adjusted for inflation).[14] To starting time this loss of purchasing power, The National Surface Transportation Infrastructure Financing Commission issued a detailed report in February 2009 recommending a 10 cent increase in the gasoline revenue enhancement, a 15 cent increase in the diesel revenue enhancement, and a reform tying both of these tax rates to inflation.[xv]

Critics of gas tax increases argue that much of the gas tax revenue is diverted to other government programs and debt servicing unrelated to transportation infrastructure.[sixteen] However, other researchers accept noted that these diversions can occur in both directions and that gas taxes and "user fees" paid by drivers are not high enough to comprehend the full toll of road-related spending.[17]

Some believe that an increased cost of fuel would besides encourage less consumption and reduce America's dependence on foreign oil.[ citation needed ] Americans sent nearly $430 billion to other countries in 2008 for the cost of imported oil.[ citation needed ] Notwithstanding and particularly since 2008, increased domestic output (e.g., fracking of shale and other energy resource discoveries) and rapidly increasing product efficiencies have significantly reduced such spending, and this falling trend is expected to continue.[18]

Aviation fuel taxes [edit]

| | Parts of this commodity (those related to revenue enhancement prices announced to be outdated as of March 2021 study) need to be updated. (March 2021) |

Aviation gasoline (Avgas): The tax on aviation gasoline is $0.194 per gallon.[ citation needed ] When used in a fractional ownership program shipping, gasoline as well is subject field to a surtax of $0.141 per gallon.[ citation needed ]

Kerosene for use in aviation (Jet fuel): Generally, kerosene is taxed at $0.244 per gallon unless a reduced rate applies.[ citation needed ] For kerosene removed directly from an on-airport final (ramp) directly into the fuel tank of an aircraft for utilise in non-commercial aviation, the revenue enhancement charge per unit is $0.219.[ citation needed ] The charge per unit of $0.219 likewise applies if kerosene is transported direct into any shipping from a qualified refueler truck, tanker, or tank wagon that is loaded with the kerosene (again, when done directly on-airport, e.g., on the ramp). Notably, the airport terminal doesn't need to be a passenger conveying, secured airport last for this rate to apply. However, the refueling truck, tanker, or tank wagon must meet the requirements discussed later nether sure refueler trucks, tankers, and tank wagons, treated as terminals.

These taxes mainly fund airport and Air Traffic Control operations by the Federal Aviation Administration (FAA), of which commercial aviation is the biggest user.[ citation needed ]

| Land | Aviation Fuel Tax (excludes federal revenue enhancement of 19.four¢/gal) | Jet Fuel Tax (excludes federal revenue enhancement of 24.four¢/gal) | Notes |

|---|---|---|---|

| Alabama | 9.5 | 3.five | |

| Alaska | 4.7 | 3.2 | |

| Arizona | 5.0 | 0 | Jet Fuel is not subject to Motor Fuel Taxes |

| Arkansas | 21.viii | 22.8 | Aviation Fuel and Jet Fuel are subject to vi.five% State Sales and Use Tax plus local sales and use tax based on point of delivery |

| California | xviii.0 | 2.0 | |

| Colorado | vi.0 | 4.0 | |

| Connecticut | exempt | exempt | Subject to additional eight.1% sales revenue enhancement |

| Delaware | 23.00 | exempt | |

| District of Columbia | 23.50 | 23.fifty | |

| Florida | 6.95[21] | vi.9 | may too be subject to local option taxes of up to an additional 12 cents |

| Georgia | seven.v | 7.5 | subject to local sales tax |

| Hawaii | one.0 | 1.0 | also field of study to county revenue enhancement of 8.8-18.0 cents and boosted sales taxation |

| Idaho | 7.0 | vi.0 | |

| Illinois | 1.1 | i.i | |

| Indiana | 49.0 | 21.0 | |

| Iowa | eight.0 | 5.0 | |

| Kansas | 24.0 | 26.0 | |

| Kentucky | 26.00 | exempt | Jet Fuel is subject field to 6% Sales Tax |

| Louisiana | exempt | exempt | Exempt if used for aviation utilise, otherwise xx.0 cents per gallon |

| Maine | thirty.0 | 3.4 | |

| Maryland | vii.0 | vii.0 | |

| Massachusetts | 27.3 | 10.9 | [22] |

| Michigan | 3.0 | three.0 | |

| Minnesota | 5.0 | 15.0 | |

| Mississippi | six.4 | 5.25 | |

| Missouri | 9.0 | exempt | Additional charges apply for agriculture inspection fee and underground storage fee |

| Montana | four.0 | iv.0 | |

| Nebraska | 5.0 | 3.0 | |

| Nevada | ii.0 | 1.0 | besides subject field to additional county taxes, up to eight cents per gallon on Aviation Fuel, iv cents per gallon for Jet Fuel |

| New Hampshire | 4.0 | 2.0 | The rate for Jet Fuel for aircraft operating nether FAR Function 121 is 0.five cents per gallon |

| New Jersey | 10.56 | 13.56 | |

| New United mexican states | 17.0 | See notes | Jet Fuel is subject field to gross receipts tax |

| New York | half-dozen.v | 6.5 | |

| Northward Carolina | 0.0025 | 0.0025 | tax is an inspection fee |

| North Dakota | 8.0 | 8.0 | |

| Ohio | exempt | exempt | |

| Oklahoma | 0.08 | 0.08 | Also in that location is a $.01 per gallon Underground Storage Fee is due on all motor fuels |

| Oregon | 11.0 | 3.0 | |

| Pennsylvania | v.5 | one.6 | |

| Rhode Island | exempt | exempt | |

| South Carolina | 0.25 | 0.25 | Taxes are for inspection fee and environmental bear upon fee |

| South Dakota | 6.0 | four.0 | |

| Tennessee | i.4 | ane.4 | |

| Texas | 20.0 | xx.0 | |

| Utah | 9.0 | half dozen.5 | 2.5 cents for federally certificated air carriers (@ international airport) 6.5 cents for federally certificated air carriers (airports other than international) nine cents/gallon all other operations |

| Vermont | 31.22 | See Notes | Jet Fuel is subject field to 6% Sales Tax |

| Virginia | 5.0 | 5.0 | |

| Washington | xi.0 | 11.0 | |

| West Virginia | 11.vii | 11.seven | |

| Wisconsin | 6.0 | vi.0 | |

| Wyoming | 5.0 | v.0 |

See besides [edit]

- Carbon taxes in the Us

- Federal Highway Trust Fund (United States)

- Gas tax holiday

- National Association of Convenience Stores

United states of america tax organisation:

- Excise tax in the United States

References [edit]

- ^ "Petroleum Marketing Explanatory Notes: The EIA-782 survey" (PDF). US Energy Data Assistants/Petroleum Marketing Monthly.

- ^ http://www.fhwa.dot.gov/infrastructure/gastax.cfm U.s. Department of Transportation, Federal Highway Administration: When did the Federal Government begin collecting the gas taxation?

- ^ "State Motor Fuel Taxes: Notes Summary" (PDF). American Petroleum Found. April 1, 2019.

- ^ Corning, Howard M. Dictionary of Oregon History. Binfords & Mort Publishing, 1956.

- ^ "A cursory history of Oregon vehicle fees and fuel taxes". The Oregonian/Oregon Live. December 12, 2010.

- ^ Ang-Olson, Jeffrey; et al. (July 1999). "Variable-Rate State Gasoline Taxes" (PDF). Institute of Transportation Studies, University of California Berkeley.

- ^ "About Americans Live in States with Variable-Rate Gas Taxes". Institute on Taxation Economic Policy. Feb five, 2016.

- ^ "Motor Fuel Taxes".

- ^ McCormally, Kevin (July 2, 2014). "A Cursory History of the Federal Gasoline Tax". Kiplinger . Retrieved October 7, 2021.

- ^ Online NewsHour: Conversation | Peters Discusses Infrastructure | Baronial 15, 2007 | PBS

- ^ "Status of The Federal Highway Trust Fund". Us Department of Transportation, Federal Highway Administration.

- ^ CPI Inflation Calculator

- ^ "What are the major federal excise taxes, and how much coin practice they raise?".

- ^ "A Federal Gas Tax for the Future". Institute on Taxation Economic Policy. September 23, 2013.

- ^ "Paying Our Way" (PDF). Archived from the original (PDF) on April 2, 2009.

- ^ Paletta, Damian (July 17, 2014). "States Siphon Gas Tax for Other Uses - WSJ". Wall Street Journal.

- ^ "Gasoline Taxes and User Fees Pay for Just One-half of Land & Local Road Spending". Tax Foundation. Jan iii, 2014.

- ^ "Red china is at present the world'due south largest cyberspace importer of petroleum and other liquid fuels - Today in Free energy - U.South. Free energy Data Administration (EIA)".

- ^ " "Motor Fuel Tax Information by Land, September 2017". Federation of Tax Administrators . Retrieved April 29, 2019.

- ^ U.S. Energy Data Administration. "State Aviation Fuel Rates - Feb 2021". Retrieved March xviii, 2021.

- ^ "Florida Announces 2019 Motor Fuel Tax Rates". November 30, 2018.

- ^ "Massachusetts Fuel Excise Rates" (PDF) . Retrieved April 29, 2019.

External links [edit]

- History of the gas taxation in the U.s.

- 2013 NACS Annual Fuels Report

Source: https://en.wikipedia.org/wiki/Fuel_taxes_in_the_United_States

Posted by: duongshateriere.blogspot.com

0 Response to "Structural Steel Detailing Service Should Charge State Taxes In Texas?"

Post a Comment