What Is A Debt Service Coverage Ratio

What is the Debt Service Coverage Ratio?

The Debt Service Coverage Ratio (DSCR) measures the power of a visitor to use its operating income to repay all its debt obligations, including repayment of principal and interest on both brusk-term and long-term debt . The ratio is oft used when a company has any borrowings on its remainder sheet such as bonds , loans, or lines of credit.

DSCR is also a commonly used ratio in a leveraged buyout transaction, to evaluate the debt capacity of the target company, forth with other credit metrics such every bit full debt/EBITDA multiple, cyberspace debt/EBITDA multiple, interest coverage ratio, and fixed accuse coverage ratio .

Debt Service Coverage Ratio Formula

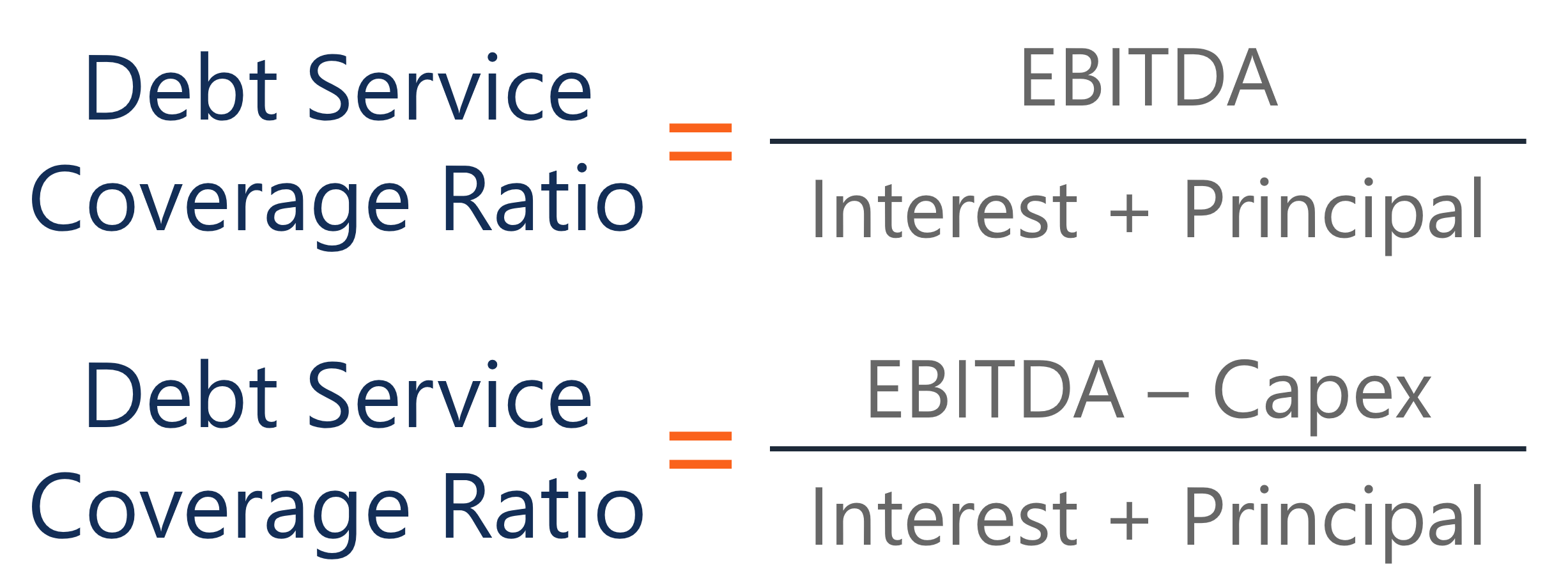

At that place are 2 ways to calculate this ratio:

Where:

- EBITDA = Earnings Earlier Involvement, Tax, Depreciation, and Acquittal

- Primary = the total loan amount of brusk-term and long-term borrowings

- Involvement = the involvement payable on any borrowings

- Capex = Capital Expenditure

Some companies might prefer to use the latter formula because capital expenditure is not expensed on the income statement but rather considered as an "investment". Excluding CAPEX from EBITDA will give the company the actual amount of operating income available for debt repayment.

Debt Service Coverage Ratio Example

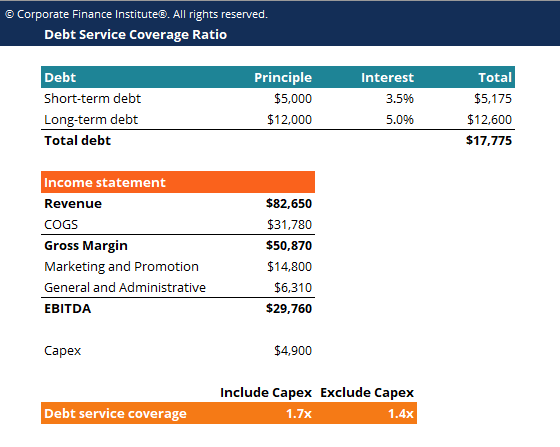

Consider a company which has brusk-term debt of $v,000 and long-term debt of $12,000. The involvement rate on the short-term debt is 3.5% and the interest rate on the long-term debt is 5.0%. Capital expenditure in 2018 is $4,900.

The company's income statement is as follows:

| Revenue | 82,650 |

| COGS | 31,780 |

| Gross Margin | 50,870 |

| Marketing and Promotion Expense | 14,800 |

| General and Administrative Expense | half-dozen,310 |

| EBITDA | 29,760 |

We can utilize the two formulas to calculate the ratio:

Debt service coverage ratio (including Capex) = 29,760 / (5,000 x (one + iii.5%) + 12,000 x (one + 5.0%)) = 1.7x

Debt service coverage ratio (excluding Capex) = (29,760 – 4,900) / (v,000 10 (1 + 3.5%) + 12,000 x (i + 5.0%)) = i.4x

Thus, the ratio shows the company tin can repay its debt service 1.7 times with its operating income and 1.4 times with its operating income, less capex.

Download the Free Template

Enter your proper noun and email in the course beneath and download the free template for the debt service coverage ratio now!

Interpretation of the Debt Service Coverage Ratio

A debt service coverage ratio of 1 or above indicates that a visitor is generating sufficient operating income to cover its annual debt and interest payments. Equally a general dominion of thumb, an platonic ratio is two or higher. A ratio that high suggests that the company is capable of taking on more debt.

A ratio of less than one is not optimal because it reflects the company'south inability to service its electric current debt obligations with operating income alone. For instance, a DSCR of 0.8 indicates that at that place is but plenty operating income to cover 80% of the company's debt payments.

Rather than just looking at an isolated number, information technology is better to consider a visitor'due south debt service coverage ratio relative to the ratio of other companies in the same sector. If a visitor has a significantly higher DSCR than most of its competitors, that indicates superior debt management. A financial analyst may as well want to look at a company'southward ratio over time – to run across whether it is trending upward (improving) or downward (getting worse).

Common Uses of the Debt Service Coverage Ratio

- The debt service coverage ratio is a mutual benchmark to measure out the power of a company to pay its outstanding debt including principal and interest expense.

- DSCR is used by an acquiring company in a leveraged buyout to appraise the target visitor'south debt structure and ability to come across debt obligations.

- DSCR is used by bank loan officers to determine the debt servicing power of a company.

Additional Resources

Thank you for reading CFI's guide to Debt Service Coverage Ratio. Cheque out some of our resources below to expand your knowledge and further your career!

- Involvement Coverage Ratio

- Projecting Residual Sheet Line Items

- Short-Term Debt

- Solvency Ratio

Source: https://corporatefinanceinstitute.com/resources/knowledge/finance/debt-service-coverage-ratio/

Posted by: duongshateriere.blogspot.com

0 Response to "What Is A Debt Service Coverage Ratio"

Post a Comment